Tax Brackets 2025 Married Jointly California. How do i calculate california income tax? Your average tax rate is.

For those who are married filing jointly, registered domestic partners filing jointly, or qualifying surviving spouses, the tax brackets are as follows: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

What Are The Tax Brackets For 2025 Married Filing Jointly Stefa Emmalynn, Quickly figure your 2025 tax by entering your filing status and income.

2025 California Tax Brackets Married Jointly 2025 Kaile Electra, The income tax calculator estimates the refund or potential owed amount on a federal tax return.

Tax Brackets 2025 Married Jointly California Rubi Wileen, And is based on the tax brackets of.

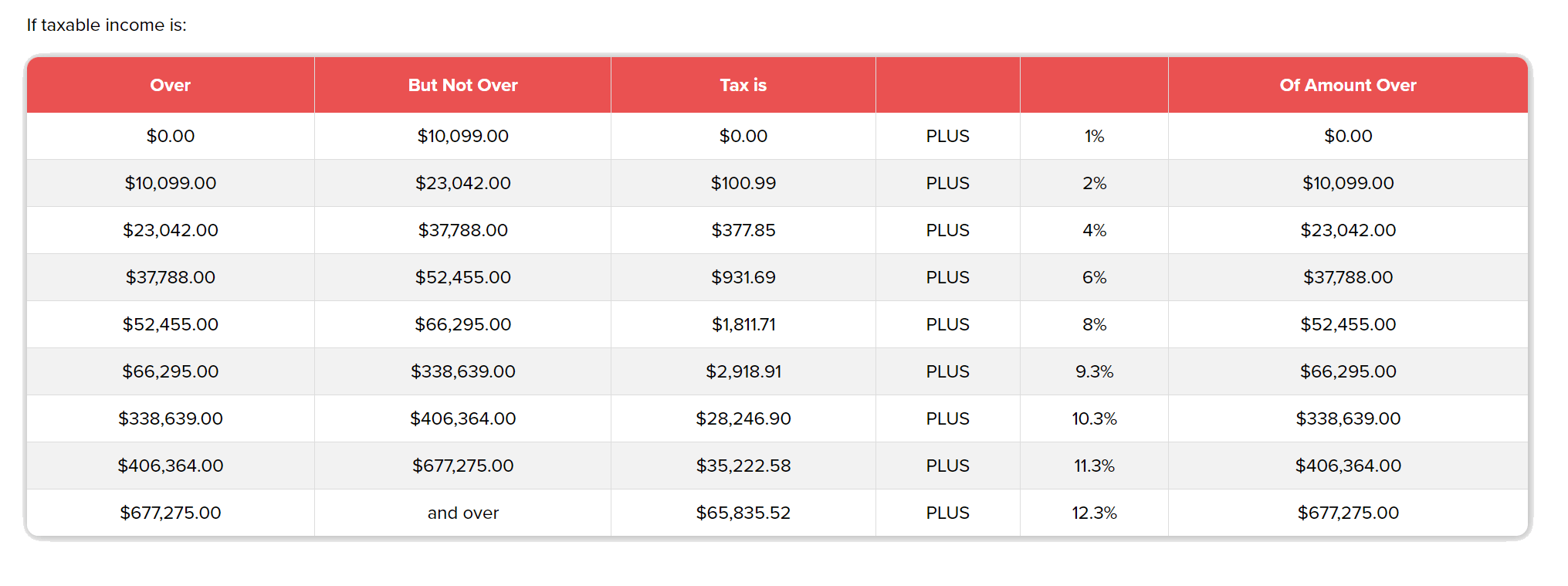

California Tax Brackets 2025 Married Jointly Brinn Clemmie, The california income tax has nine tax brackets.

California Tax Brackets 2025 Married Jointly Brinn Clemmie, The standard deductions in california for 2025 tax returns are $5,363 (single or married/rdp filing separately) and $10,726 (married/rdp filing jointly, qualifying surviving spouse, or head of household).

California Tax Brackets 2025 Married Filing Jointly Aggie Sonnie, Married/registered domestic partner filing jointly or qualified widow(er)

Married Joint Tax Brackets 2025 Rahel Latashia, This page has the latest california brackets and tax rates, plus a california income tax calculator.

2025 Tax Brackets Announced What’s Different?, Quickly figure your 2025 tax by entering your filing status and income.

Us Tax Brackets 2025 Married Filing Jointly Calla Corenda, The deadline to file a california state tax return is april 15, 2025, which is also the deadline for federal tax returns.

Short Hairstyles For Men 2025. Explore the 2025 haircut trends for males, including the timeless […]

Jobs Report 2025 Dates India. The information technology sector will see a more conservative hiring […]

Copa America 2025 Match Highlights. In the first half, argentina faced a surprising ecuadorian team […]